While insurers doing business in the U.S. continue to increase rates on their in-force blocks of individual long-term care policies, one company officially stopped accepting new business applications during the second quarter.

Aegon NV's Transamerica notified Virginia regulators it would stop selling individual stand-alone long-term care, or LTC, polices across the U.S. in early summer, according to a review of a product filing. However, the insurer will still issue multi-life policies in some instances due to contractual commitments during future open enrollment periods.

Transamerica is not exiting the LTC market completely; it will still offer its LTC rider that can be attached to life and/or annuity products, commonly referred to hybrid or combination products. Regulatory documents filed for full year 2020 show that Transamerica added an additional 20,728 covered lives that year within its hybrid products, versus only 6,158 lives on its stand-alone LTC product.

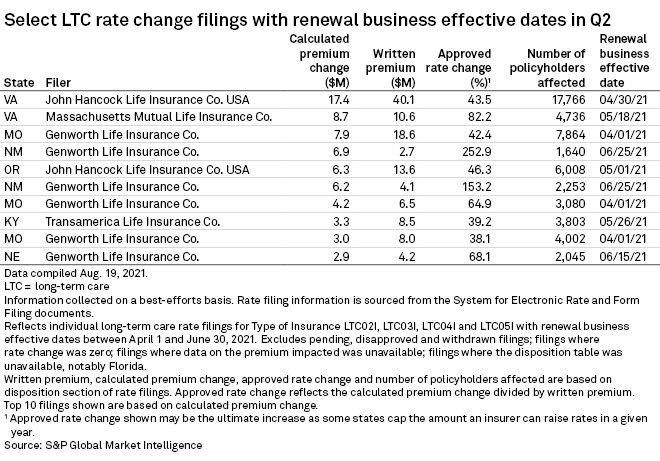

Transamerica has also made progress in securing rate hikes on individual LTC policies that renewed during the second quarter. The most impactful filing for Transamerica Life Insurance Co. occurred in Kentucky, where the insurer could see its annual calculated premiums rise by roughly $3.3 million. The average rate hike in the Bluegrass State is 39.2%, and the increase will impact 3,803 policyholders.

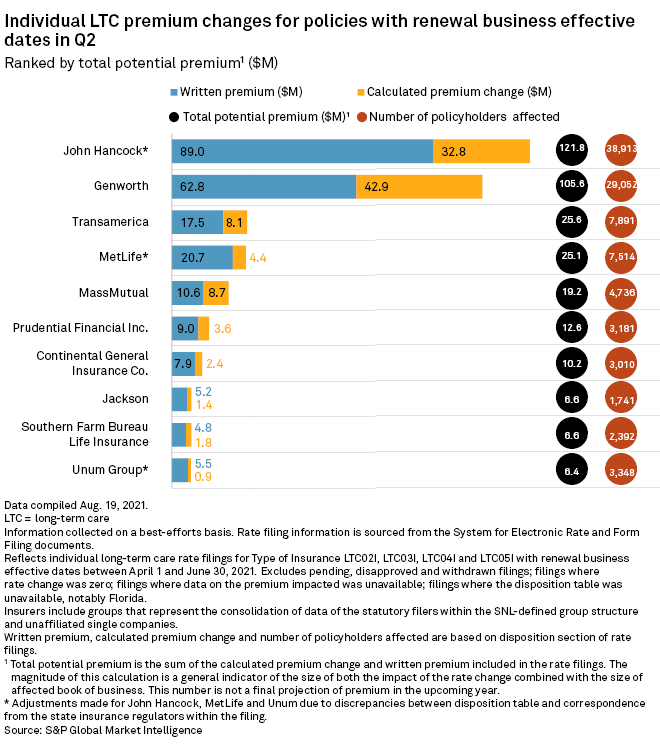

Manulife Financial Corp.'s John Hancock Life Insurance Co. (USA) may have experienced the most impactful rate increase on an in-force block of business during the quarter. A single Virginia filing could increase the insurer's annual calculated premium by $17.4 million. Of the filings reviewed for John Hancock, its individual LTC premiums could rise across nine states during the second quarter, and the insurer may see its annual premiums climb by $32.8 million.

Genworth Financial Inc.'s calculated annual premium increase of $42.9 million was the largest aggregate total for the second quarter. The aggregate increases are spread over seven states, with the largest calculated premium hike of $16.6 million occurring in Missouri. New Mexico is a close second at $16.4 million.